DO NOT BE TRAPPED BY FEED COST

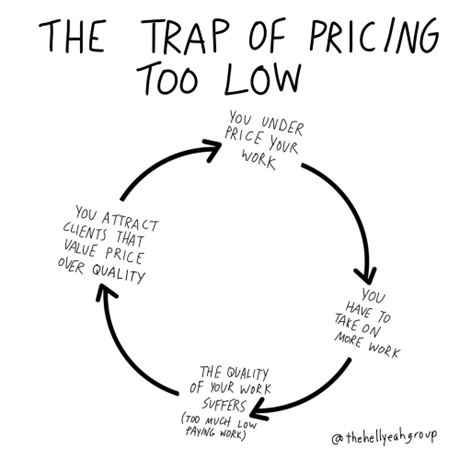

Nutritionists and formulators have the very difficult mission to optimize feed performance within a restricted feed cost. Often the cost restriction prevents from adding the level of nutrients or the additives that would be needed to improve animal performance.

Most of our markets are indeed very sensitive to prices and it is critical for a feedmiller to match market leaders’ prices if they want to compete on the bulk of the market. Adding more constraints to their feed would reduce their margin and most of companies are not ready to do that.

But feed cost is not the proper criteria to select the optimal diet. The goal of all our industry is to reduce the cost per kilogram of lean meat or egg. It may sound counter-intuitive but to reduce meat or egg cost, we may need to increase feed cost in order to enable nutritionists to include in their diets some new strategies with proven effect on reducing carcass or egg cost.

That is the main advantage of integrated organization. As all stakeholders of integrated chain share the same ambition to reduce final carcass cost, they can easily find an agreement on the nutritional and feed additives strategies without paying too much attention on the feed cost. The cost of the diet becomes a consequence of their strategies and not a prerequisite.

In commercial organizations where each stakeholder defends their own profitability, the goals may appear divergent. The farmers believe that to improve his profitability, he needs to reduce the cost of the feed and he sees every increase of feed cost from his feed manufacturers as an obstacle. Such beliefs based on a lack of communication and transparency creates a divergence of vision and destructive opposition.

Basically, there are no reason why commercial organizations should manage the meat production chain in a different way than integrated companies do. The expected behaviors and technical solutions should be similar if we want commercial organizations to stay competitive.

To do so, commercial feed manufacturers and farmers need to sit together and review the way they want to collaborate. They need to redefine together the priorities and set the KPI needed to define performance and success. Such approach will require some efforts on both sides.

Farmers needs to be very rigorous in the way they will measure the cost of lean meat and egg. If that criteria become to main driver to take decision, it must be reliable and transparent for all the stakeholders of the chain, from the genetic provider, the feed manufacturer, veterinarians and even to the farm workers.

As far as the feed manufacturer is concerned, he needs to be transparent in explaining the strategies that he is proposing to reduce meat / egg cost. That must cover the nutrients level and the additives solutions he selected but that can include the pellet technological properties as well. Feed manufacturers have as well the responsibilities to search for innovative solutions by keeping open-minded approach in their discussion with their suppliers. Feed additives, ingredients and even machines suppliers are the main source of innovation for feed manufacturers and to be performing, it is important to stay ahead of competition to lead the changes and not be reactive and late adopters.

Most of markets are already moving in these directions. Most of feed manufacturers proposes different feed profiles depending on the customers segments they are approaching. There are mainly 3 major customers segments.

Segment 1 - Traditional farmers who mostly look at feed cost – feed manufacturers are reducing specifications to the lowest level of nutrients to ensure the lowest cost possible with minimal security in term of ingredients and nearly no additives

Segment 2 – Farmers who are already buying feed from competitors at a medium price – in that situation, feed manufacturers will propose a standard diet quite similar in strategies and price to competitors to grab market share – it is more about copying competition rather than creating differences

Segment 3 – Farmers who understood that feed cost is not the right criteria to select feed strategies but are rather focusing on reducing meat / egg cost – in that scenario, feed manufacturers need to propose one or several premium diets including several of the strategies illustrated above.

The segment 1 is tricky as it is targeting farmers that may not be the most productive and it can easily turn out as not profitable and lead you to damage your reputation. But it is often the only way to position ourselves when we are going through distribution networks. The more middle persons we add in the chain and the more difficult it is to communicate messages of differentiation. The only point that carries through the networks until the farmer is the price.

The segment 2 brings volume but stay very competitive in term of prices with limited loyalty. On that segment, we are gaining customers by offering a ‘standard’ diet and gaining customers loyalty through commercial relationship and/services. It is more a commercial than a technical strategy.

That segment cannot be ignored as all feed manufacturers are looking for volume to operate their factory. But it has to be considered as a volume strategy with limited profitability.

The segment 3 is the most selective but the most profitable. The relationship is built on the trust that the feed proposed can reduce the meat / egg cost based on nutritional strategies that have been selected…over a long period of time…in collaboration between the farmer and the feed nutritionists. In that context, farmers should not argue on feed price.

That approach requires a customized design of each diet to ensure that the farmer accept each nutritional strategy proposed to him. That requires a high level of flexibility from the feed manufacturers and an intimate relationship with farmers. It is important as well to get a perfect alignment inside the feed manufacturers company between the nutritionists’ team and the sales team. The salesperson who are managing customer relationship needs to get sufficient technical background to understand the final goal and build customer trust on feed performance based on objective field results.

We need to be careful as well on the way we celebrate success inside the feed manufacturer. If we are targeting the segment 2 with a volume strategy, the performance indicator can / should be the volume sold expressed either in tons of feed or in turn over. But in case we are focusing on the segment 3, we should focus on cost of carcass or eggs and not in tonnage of feed. That requires a full access and circulation of the farm data across the stakeholders.

If we set tonnage as priority when dealing on segment 3, very quickly, salesmen will start discussing reduction prices to gain more customers and we will end up going back to the segment 2.

The optimal strategy for commercial feed manufacturer should be a mix between segment 2 and 3; segment 2 for gaining volume and segment 3 for gain profit and loyalty.

I selected three segments but there are actually as many segments as you want to define depending on the different purchase behaviors of your customers.

The trend that we are seeing on the most sophisticated markets is not very positive for commercial feed manufacturers. Firstly, their accessible market is shrinking as more and more farmers are integrating the feed production. Farmers of certain size believe that they have sufficient expertise to make a diet as performing as the one they were buying from their feed manufacturer. But even in their accessible market, there is a shift of prescription. Farmers are now giving to feed manufacturers the diet they want them to produce. Feed manufacturers are then becoming only millers without any power of prescription and that significantly reduces their profitability.

It is therefore important for commercial feed manufacturers to maintain a high level of expertise and maintain a technical edge versus both their competitors and the farmers by keeping on innovating. As soon as they lose that edge, farmers may be tempted by mixing diets by themselves.

This is where ingredients and additives suppliers can contribute. Animal nutrition industry is innovating at a fast pace, and it is critical for all animal nutritionists to stay on page by multiplying meeting with suppliers first to understand the trends on other international markets and second to identify solutions that could interest their customers to reduce lean meat and egg cost.

Comments